Gold Price Plummets: Is Now the Time to Buy? Geopolitical Analysis & Investment Strategy

By Jane Doe on February 02, 2026

4,786 views

Key Takeaways

- Understand how Federal Reserve policy changes can influence the gold price and your investment strategy.

- Assess the impact of geopolitical events on the current gold market trends and potential future movements.

- Analyze the technical chart to identify key support and resistance levels for informed gold investment decisions.

- Consider the Fear & Greed Index as a gauge of market sentiment when making decisions about buying or selling gold.

Gold Price Tumbles: Geopolitical Shifts and Your Portfolio

As a Geopolitical & Macroeconomic Strategist, I'm constantly monitoring how global events translate into tangible impacts on your investments. The recent announcement from the Federal Reserve might seem distant, but it has direct consequences for your gold holdings. Let me explain the connection. News regarding the potential nomination of a new Fed chair has injected uncertainty into the market, triggering a sell-off and causing the gold price today to experience a significant dip.

At the time of writing, the live gold price stood at $4728.24, a decrease of $164.96 from the previous day's close of $4893.2. This represented a change of -3.371%. The current gold price reflects investor anxieties surrounding potential shifts in monetary policy and the broader economic outlook. This is not just about numbers; it's about understanding the story behind them and how they impact your financial future.

Decoding the Market Drivers

The slide in the gold price per ounce can be attributed to a confluence of factors, most notably the speculation surrounding the new Fed chair. The market interpreted this as a sign that the Federal Reserve might maintain its hawkish stance on inflation, potentially leading to higher interest rates. Higher interest rates typically diminish the appeal of gold investment, as they increase the opportunity cost of holding a non-yielding asset. All eyes are on the Fed as its decisions send ripples throughout the global economy. Savvy investors need to stay informed and adapt their strategies accordingly.

Adding to the downward pressure is the general market sentiment. The Fear & Greed Index, a measure of investor sentiment, is currently at 13/100, indicating extreme fear. This heightened level of fear often leads to risk-off behavior, with investors flocking to the U.S. dollar and other safe-haven assets, further weighing on xau/usd. To understand more, it's helpful to visit Investopedia for background.

Technical Outlook

Let's delve into the technical picture to gain further clarity on potential future price movements.

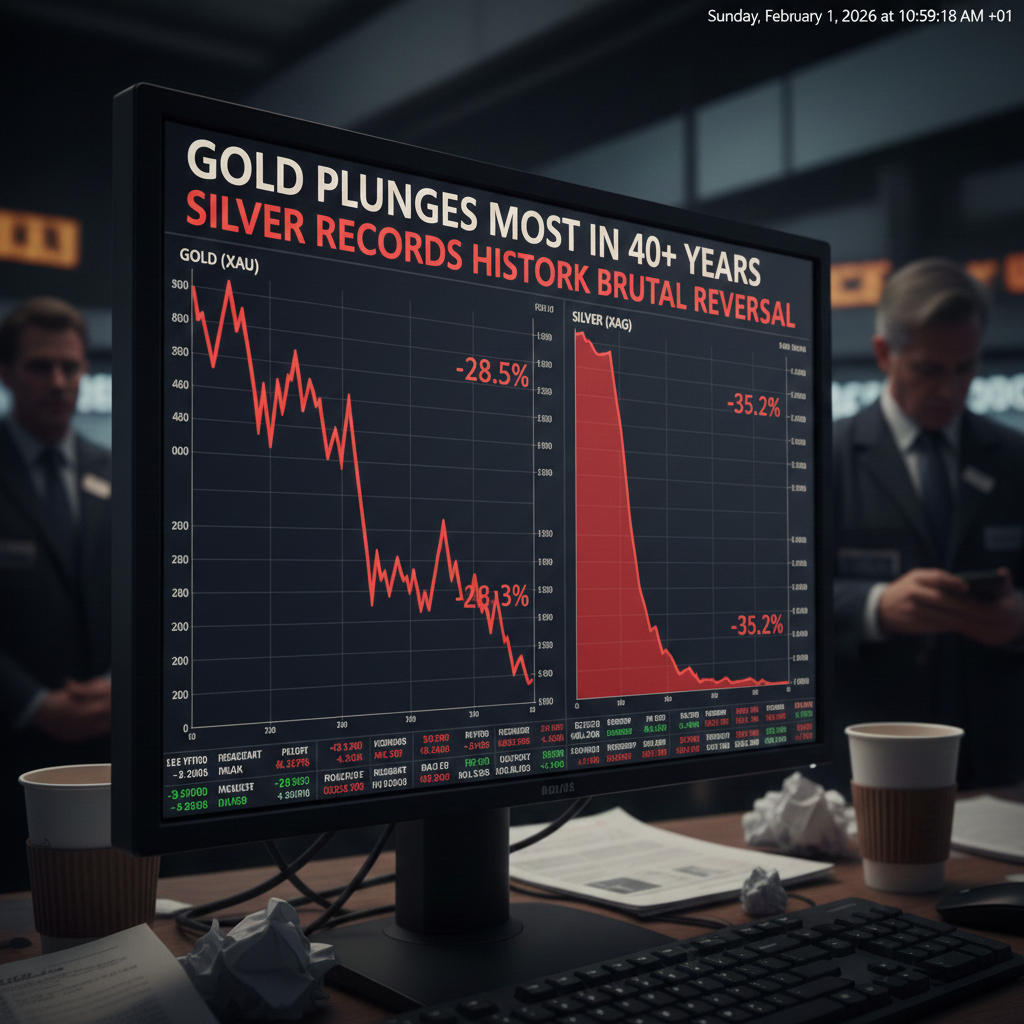

As you can see from the chart, the recent sell-off has broken through a key support level, suggesting further downside potential in the short term. The Relative Strength Index (RSI) is approaching oversold territory, which could signal a potential bounce. However, it's crucial to monitor price action closely for confirmation. Investors should be watching for a potential test of lower support levels before considering any significant accumulation of gold investment.

Contrarian View

While the short-term outlook appears cautious, it's essential to consider alternative scenarios. If geopolitical tensions were to escalate sharply, or if the Federal Reserve were to signal a more dovish stance, we could see a swift reversal in the gold market trends. Additionally, persistent inflation could renew gold's appeal as a hedge against rising prices.

Navigating the Uncertainty: A Cautious Approach

Given the current environment, a cautious approach is warranted. While the dip in the gold price may be tempting for bargain hunters, it's crucial to remember that uncertainty remains high. Consider diversifying your portfolio and allocating a portion to precious metals, but avoid making any rash decisions based on short-term market fluctuations. Staying informed about gold news and precious metals analysis is key to making sound investment decisions. Don't forget that you can set up AI-powered price alerts for precious metals, which will make it much easier to keep track of the live gold price.

Remember that tracking your portfolio is critical to ensuring you are properly diversified. I encourage you to use Our free tool to track the real-time value of your investments.

Gold Price Around the World

The gold price can fluctuate based on a variety of local economic factors. If you are interested, you can view the price in your local currency:

FAQ: Gold Investment in a Volatile Market

Is now a good time to buy gold given the recent price drop?

The recent drop in gold price, with the live gold price at $4728.24, may present an opportunity for long-term investors. However, given the high volatility and uncertainty surrounding Fed policy, a cautious approach is recommended.

How is the Fed chair nomination impacting the gold price?

The nomination news is interpreted as a sign that the Federal Reserve might maintain a hawkish stance on inflation, potentially leading to higher interest rates, reducing the appeal of gold investment.

Ready to seize opportunities in the precious metals market? Visit our academy and enhance your understanding of gold investment strategies!

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice.

Written by

Jane Doe

Geopolitical & Macroeconomic Strategist

Jane Doe holds a Master's degree in International Relations from a prestigious university and specializes in the critical intersection of geopolitics and finance. She has advised government agencies and multinational corporations on how global events, central bank policies, and cross-border trade flows impact commodity markets. Jane's analysis, which has been cited in major financial publications like The Wall Street Journal and Bloomberg, provides investors with the crucial macro context needed to understand the long-term drivers of the gold price.

%20Forecast%20Outlook%20Turns%20Volatile%20as%20Speculative%20Buying%20Detaches%20From%20Demand%20GOLDZAG.COM.png?alt=media&token=253a6f20-9cd7-43db-8192-d90a45b9b4b8)