Gold Price Today: XAU/USD Suffers Biggest Drop in Decades - What's Next?

By Alex Burry on February 01, 2026

5,154 views

Key Takeaways

- Gold experienced a significant technical breakdown, prompting a re-evaluation of short-term bullish positions.

- The Fear & Greed Index at 45 suggests a shift towards neutral sentiment, potentially indicating further price consolidation or correction.

- Investors should closely monitor key support levels for potential buying opportunities amidst the current volatility.

- Consider using our free tool to track the real-time value of your investments. /portfolio-tracker

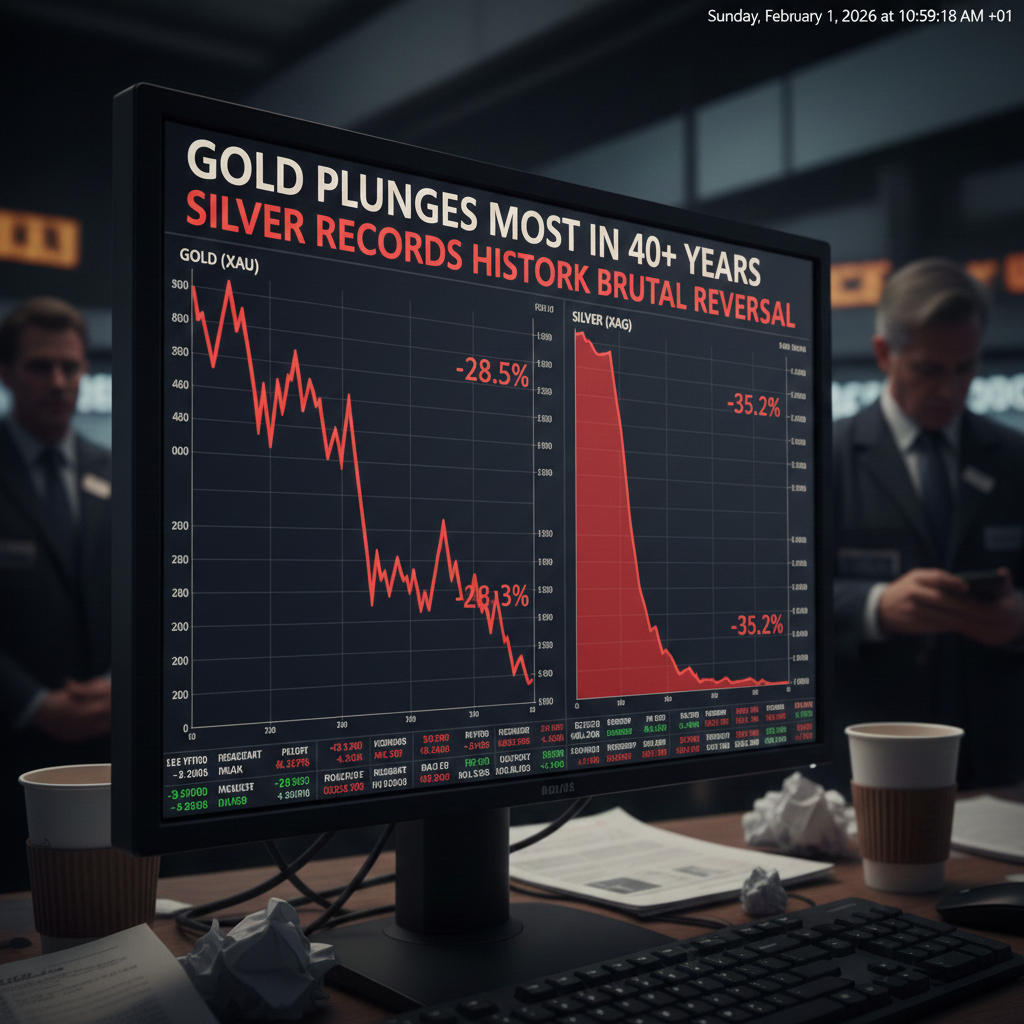

Gold Price Today: Technical Breakdown Leads to Historic Plunge

Let's break down the numbers. This week's price action in the gold market tells a clear story: a significant technical breakdown. The XAU/USD experienced a brutal reversal, triggering a wave of selling pressure. As Chief Market Analyst, I'm here to provide a data-driven perspective on this dramatic event and what it means for your gold investment strategy.

Current Gold Price Analysis

According to the data at the time of analysis, the live gold price was $4893.2. This represented a change of $-434.448 from the previous day's close of $5327.65, a staggering -8.155% decline. This is not just a minor correction; it's a substantial move that demands our attention. Such a large intraday drop is certainly a shock for investors. We need to assess the underlying reasons and potential for continued volatility.

Technical Indicators and Market Sentiment

The Fear & Greed Index currently sits at 45/100. This neutral reading indicates that market sentiment is shifting away from extreme greed, suggesting that investors are becoming more cautious. This shift in sentiment often precedes further price corrections or periods of consolidation. It's crucial to monitor this index in conjunction with price action to gauge the overall market temperature. For more insights, consider analyzing the current and historical Gold-to-Silver ratio. /tools/gold-silver-ratio

Analyzing the Chart

A closer look at the technical chart reveals that gold has broken below several key support levels. This breach of support suggests that the downward momentum could persist in the short term. The next critical level to watch is around $4800; a break below this could open the door for further declines. Conversely, if gold can find support around these levels, we might see a period of consolidation before the next major move.

Contrarian View

It's important to consider alternative scenarios. While the technical outlook appears bearish in the short term, a resurgence of geopolitical tensions or a sudden weakening of the U.S. dollar could trigger a sharp reversal in gold prices. Keep in mind that gold often acts as a safe-haven asset during times of uncertainty. Furthermore, potential supply disruptions could also drive the price higher. Always be prepared for multiple outcomes.

Market Drivers and Macroeconomic Factors

Several factors are likely contributing to this recent sell-off. Rising bond yields and a stronger dollar often put downward pressure on gold prices, as gold becomes relatively less attractive compared to interest-bearing assets. Furthermore, positive economic data can reduce the appeal of gold as a safe haven. Keep abreast of all gold news. These macroeconomic forces play a significant role in shaping gold market trends.

Gold Price Forecast and Investment Strategy

Given the current technical breakdown, a cautious approach is warranted. Investors should consider reducing their exposure to gold in the short term, especially if key support levels continue to be breached. However, for long-term investors, this correction could present a buying opportunity, provided that gold finds support at lower levels. It's essential to conduct thorough research and consult with a financial advisor before making any investment decisions. You can see the live gold price in UK. /gold-price/uk

FAQ Section

Why did the gold price drop so significantly today?

At the time of writing, the gold price per ounce dropped significantly due to a combination of technical selling, rising bond yields, and a stronger U.S. dollar. The -8.155% intraday decline reflects a substantial shift in market sentiment.

Is now a good time to invest in gold?

The current gold price presents a mixed picture. While the sharp decline might be unsettling, it could also represent a potential entry point for long-term gold investment. Monitor key support levels and consider diversifying your portfolio. It's advisable to set up AI-powered price alerts for precious metals. /alerts

Ready to take control of your financial future? Use our educational hub for learning about precious metals investment. /academy

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice.

Written by

Alex Burry

Chief Market Analyst

With over 15 years of experience on the trading floors of major financial institutions, Alex Burry is a seasoned market analyst specializing in precious metals and commodities. As a Chartered Financial Analyst (CFA), he combines rigorous quantitative analysis with a deep understanding of market psychology. Alex is renowned for his data-driven models that have successfully forecasted major turning points in the gold market. His expert commentary focuses on translating complex technical indicators and market data into clear, actionable insights for both retail and institutional investors.

%20Forecast%20Outlook%20Turns%20Volatile%20as%20Speculative%20Buying%20Detaches%20From%20Demand%20GOLDZAG.COM.png?alt=media&token=253a6f20-9cd7-43db-8192-d90a45b9b4b8)