Gold Price Forecast February 2026: XAU/USD Volatility Sparks Top – Is Gold Still a Buy?

By Alex Burry on January 31, 2026

6,956 views

Key Takeaways

- Recent XAU/USD volatility may signal a short-term market correction.

- Despite price drops, fundamental factors support a bullish long-term outlook for gold.

- Monitor the Fear & Greed Index for shifts in market sentiment.

- Consider using tools like our portfolio tracker to manage gold investments during volatile periods.

Gold Price Forecast: Volatility Surge Sparks Questions About a Potential Top

Hello, I'm Alex Burry, Chief Market Analyst here at GoldZag. Today, we're diving into the recent volatility observed in the gold market and what it means for investors. The question on everyone's mind: Is this a temporary dip, or a sign of a larger correction?

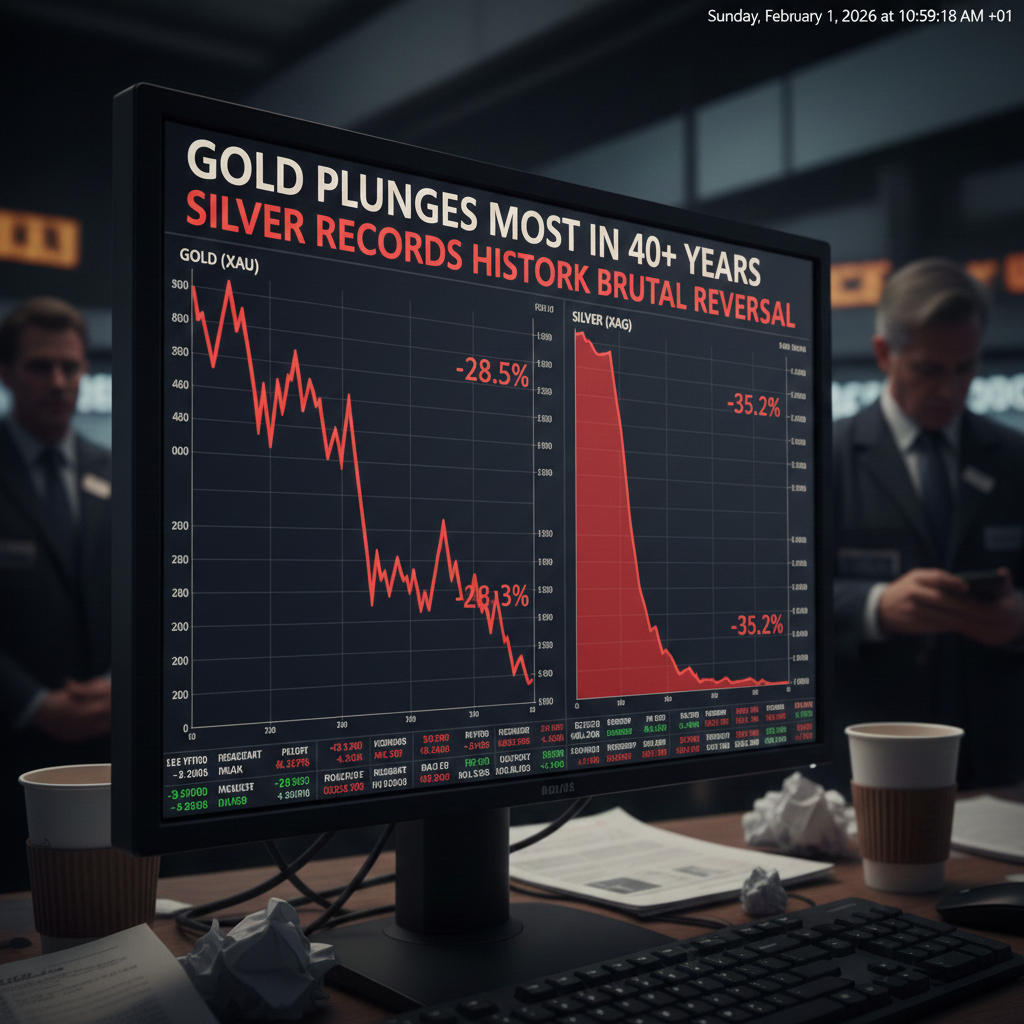

The gold market (XAU/USD) has experienced a tumultuous period. At the time of writing, the live gold price stands at $4893.2. This represents a substantial decrease of $-434.448 from the previous day's close of $5327.65, translating to a daily change of -8.155%. Such a significant intraday move naturally raises concerns and warrants a closer examination.

Current Gold Market Trends

While daily fluctuations can be alarming, it's crucial to maintain a long-term perspective when it comes to gold investment. Several underlying factors continue to support a bullish outlook for gold, including geopolitical instability, inflation concerns, and central bank policies. These elements often drive investors toward gold as a safe-haven asset. You can use our asset comparison tool to see how Gold compares to other investments.

Technical Outlook

Let's analyze the technical picture to gain further insights into potential future price movements.

The chart above illustrates the recent price action. We can observe a sharp decline, breaking through previous support levels. The Relative Strength Index (RSI) indicates oversold conditions, which could suggest a potential bounce in the near term. However, the overall trend appears to be downward, at least temporarily. Monitoring key resistance levels will be crucial in determining if the price can recover.

Market Drivers & Sentiment

Investor sentiment plays a significant role in gold price movements. The Fear & Greed Index, a measure of overall market sentiment, currently sits at 45/100. This indicates a state of fear, but not extreme fear. This level suggests that investors are becoming more cautious, which can sometimes precede further price declines, but can also represent a buying opportunity for long-term investors. Keep track of changing sentiment with our AI powered price alerts.

Broader economic conditions are also impacting the gold price today. Rising interest rates, for example, tend to put downward pressure on gold as they increase the opportunity cost of holding a non-yielding asset. Investors should pay close attention to macroeconomic data releases and central bank announcements for clues about the future direction of gold prices. For a deeper understanding of how economic factors influence gold, consider exploring our educational hub.

Contrarian View

While the current volatility might suggest a looming top, it's important to consider alternative scenarios. A sudden escalation of geopolitical tensions or an unexpected surge in inflation could quickly reignite demand for gold, pushing prices higher. Additionally, central bank buying of gold could provide a strong floor for prices, as central banks diversify their reserves. Therefore, selling all gold holdings based solely on the recent price drop may not be prudent.

Long-Term Gold Investment Strategy

Despite the recent turbulence, we maintain a bullish long-term outlook for gold. Gold has historically served as a reliable store of value, particularly during times of economic uncertainty. Diversifying your portfolio with gold can help mitigate risk and potentially enhance returns over the long run. For investors considering entering the gold market, this period of volatility may present a buying opportunity. Consider dollar-cost averaging to mitigate the impact of short-term price swings, as described by Investopedia Written by Chief Market Analyst With over 15 years of experience on the trading floors of major financial institutions, Alex Burry is a seasoned market analyst specializing in precious metals and commodities. As a Chartered Financial Analyst (CFA), he combines rigorous quantitative analysis with a deep understanding of market psychology. Alex is renowned for his data-driven models that have successfully forecasted major turning points in the gold market. His expert commentary focuses on translating complex technical indicators and market data into clear, actionable insights for both retail and institutional investors.Alex Burry

%20Forecast%20Outlook%20Turns%20Volatile%20as%20Speculative%20Buying%20Detaches%20From%20Demand%20GOLDZAG.COM.png?alt=media&token=253a6f20-9cd7-43db-8192-d90a45b9b4b8)