Gold Price Forecast February 2026: XAU/USD Volatility Signals Potential Top

By Jane Doe on January 30, 2026

8,434 views

Key Takeaways

- Gold (XAU/USD) faces strong selling pressure, indicating potential downside risk.

- Technical analysis suggests key support levels need to be monitored closely.

- The Fear & Greed Index at 45 reflects a shift towards neutrality, reducing bullish momentum.

- Investors should consider hedging strategies to mitigate potential losses in gold holdings.

Gold Price Forecast 2025: Volatility Surge Signals Possible Top for XAU/USD

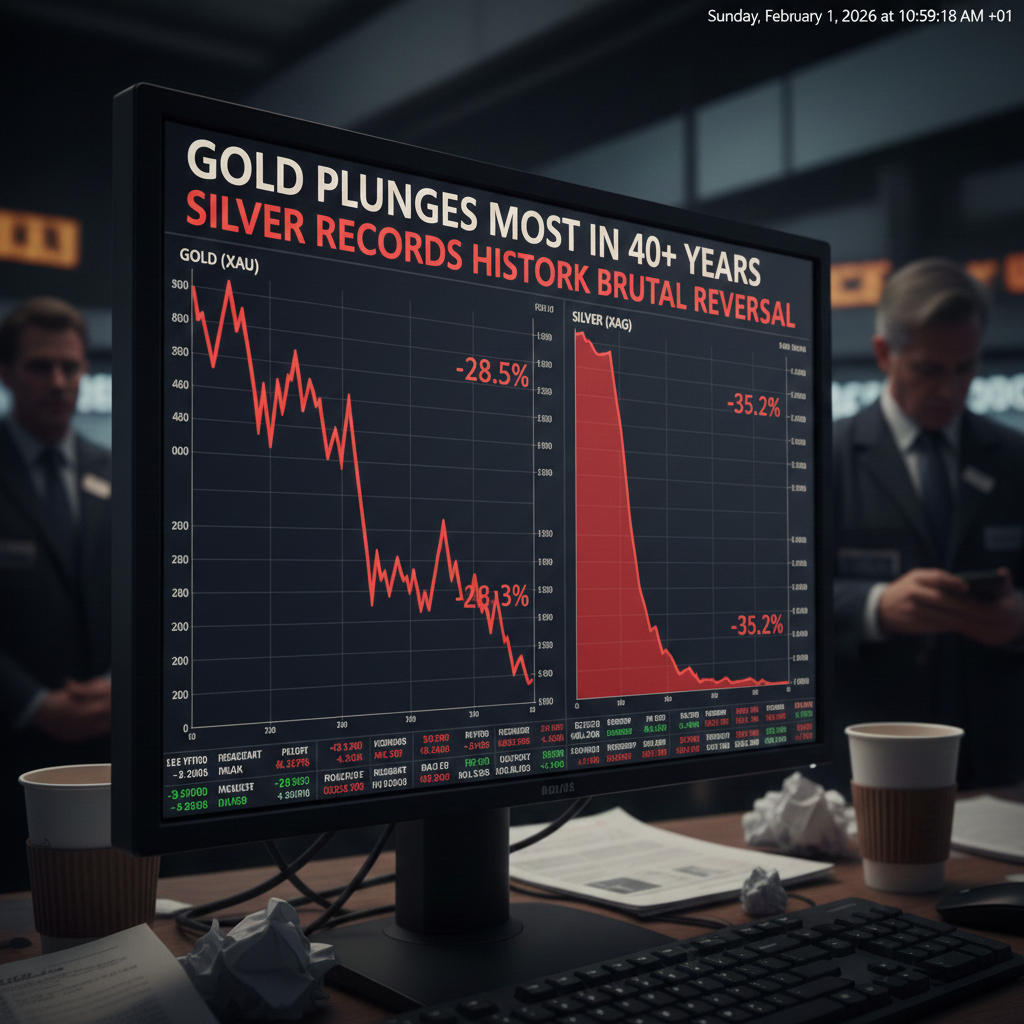

The gold market is experiencing a significant shakeup. At the time of writing, the live gold price (XAU/USD) has plunged to $4893.2, a stark contrast to the previous day's close of $5327.65. This represents a substantial daily change of $-434.448, or -8.155%. This volatility warrants a closer look at the technical factors influencing the gold price forecast and potential future gold market trends. For investors tracking the gold price today, this sharp decline raises critical questions about the sustainability of the recent bullish run and the overall outlook for gold investment.

Technical Outlook

The recent price action in XAU/USD suggests a possible shift in market dynamics. A significant sell-off like this often indicates a weakening of bullish sentiment and the potential for further downside movement. The market's reaction at key support levels will be crucial in determining whether this is a temporary correction or the start of a more prolonged downtrend. Keep track of the current gold price using our AI-powered price alerts.

Analyzing the provided technical chart, we can observe a clear breakdown below a key moving average, acting as dynamic support. The Relative Strength Index (RSI) has also moved into oversold territory, often indicating a potential bounce. However, given the magnitude of the recent decline, any rallies should be treated with caution and viewed as potential selling opportunities. Monitoring the 50-day and 200-day Exponential Moving Averages (EMAs) will be crucial in identifying potential resistance levels and confirming the overall trend direction. These chart indicators are useful in predicting the gold price per ounce. For those looking to compare gold price USA with other investment options, use our asset comparison tool.

Contrarian View

While the current technical outlook suggests a possible top, several factors could invalidate this analysis. A resurgence in geopolitical tensions, a sharp decline in the US dollar, or unexpected inflationary pressures could reignite bullish momentum in gold. Additionally, strong physical demand from major gold-consuming nations like India and China could provide support for prices, thus impacting the gold price India.

Market Drivers & Sentiment

The current market sentiment, as reflected by the Fear & Greed Index at 45, indicates a move towards neutrality. This contrasts with the higher levels of greed seen recently, which often precede market corrections. Investors are becoming more cautious, likely influenced by concerns about rising interest rates and the potential for a global economic slowdown. Keep an eye on news affecting gold price UK, as global events often have an impact. This uncertainty in the broader financial markets typically benefits gold, which is viewed as a safe haven asset. However, the strength of the US dollar and real interest rates remain key headwinds for gold prices. For a deeper dive, explore our educational hub.

Gold as a Safe Haven

Gold's role as a safe-haven asset is continuously being tested by competing narratives. On one hand, uncertainty surrounding global growth and geopolitical risks often drives investors towards gold, increasing its demand and price. On the other hand, rising interest rates and a strong dollar can diminish gold's appeal, as it offers no yield and becomes more expensive for international investors. The interplay of these factors will likely dictate the short- to medium-term trajectory of gold prices. Read more about how economic indicators influence gold prices on reputable financial news outlets such as Reuters.

FAQ

What is driving the current volatility in the gold market?

The current volatility is primarily driven by profit-taking after a strong rally, coupled with concerns about rising interest rates and a strengthening US dollar. The steep 8.155% decline and live gold price of $4893.2 reflects this heightened uncertainty.

Is now a good time to invest in gold?

Given the current market conditions and technical indicators, investors should exercise caution. The potential for further downside movement exists, and it may be prudent to wait for a more stable base to form before considering new positions. You can also use our free tool to track the real-time value of your investments.

What are the key support levels to watch for XAU/USD?

Key support levels to monitor include previous swing lows and the 200-day Exponential Moving Average (EMA). A break below these levels could signal further downside potential.

Ready to take control of your precious metals portfolio? Sign up for our free newsletter today and receive exclusive insights, market analysis, and trading strategies to help you navigate the dynamic world of gold investing!

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice.

Written by

Jane Doe

Geopolitical & Macroeconomic Strategist

Jane Doe holds a Master's degree in International Relations from a prestigious university and specializes in the critical intersection of geopolitics and finance. She has advised government agencies and multinational corporations on how global events, central bank policies, and cross-border trade flows impact commodity markets. Jane's analysis, which has been cited in major financial publications like The Wall Street Journal and Bloomberg, provides investors with the crucial macro context needed to understand the long-term drivers of the gold price.